Stop Losing Money to Failed Payments

Mintly's bank validation API helps businesses reduce payment errors by up to 90%, saving thousands in fees and admin time. Validate sort codes, account numbers, IBANs, and SWIFT codes in milliseconds with our fast, reliable API and collaborative web tools.

10M+

Accounts checked99.95%

Service Uptime<60ms

Mean Response Time

Eliminate Failed Payments

Reduce payment errors by up to 90%. Verify bank account details in real-time before processing to avoid costly bounced payments, refund fees, and customer disputes. Save thousands in banking fees every month.

All UK banksIBAN supportedAccelerate Customer Onboarding

Instant validation means faster account setup and improved customer experience. Reduce onboarding time by 60% with real-time verification. Get customers paying sooner and improve cash flow immediately.

<60ms responseReal-timeStay Compliant & Secure

Meet BACS requirements for pre-submission validation. Reduce fraud risk by verifying bank branch details. GDPR compliant with Cyber Essentials certification. Weekly data updates ensure accuracy.

GDPR compliantCyber EssentialsHow it works

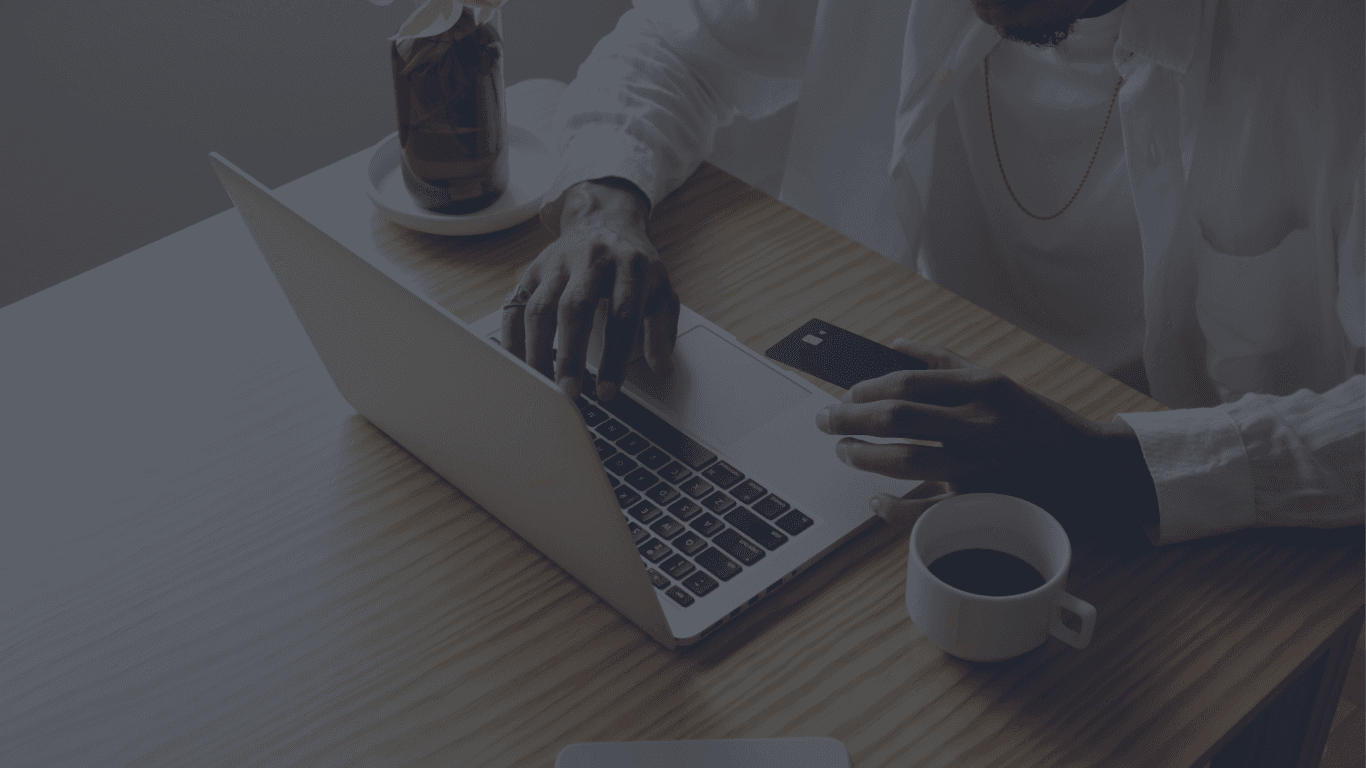

Create your account and choose a plan that suits your needs. Enjoy full functionality during the trial period with no commitment required.

Access Mintly's intuitive web tools or integrate our robust API into your systems. Collaborate effortlessly by inviting team members to use the tools with you.

.ad493cfe.png&w=3840&q=75)

Experience fewer payment failures and enhanced cash flow by ensuring account details are accurate before processing transactions.

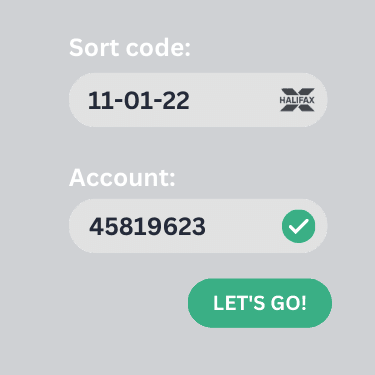

Try it yourself

See Mintly in action - validate a UK bank account for free, no registration required.

Try our account and sort code checker

Get your free PDF "The Finance Manager's 5-Minute BACS Compliance Checklist"

Get your free PDF "The Finance Manager's 5-Minute BACS Compliance Checklist"Built for developers and business teams alike

Whether you need API integration or easy-to-use web tools, Mintly has you covered.

For Developers

RESTful API Integration

Modern OpenAPI 3.0 specification with comprehensive documentation. Get started in minutes with code examples in Node.js, Python, PHP, and more.

- OpenAPI 3.0 specification

- Multi-language examples

- 99.95% uptime SLA for Enterprise Plans

- MCP Server compatible for AI integration

Trusted by businesses across the UK

See what our customers say about Mintly's bank validation services.

Everything you need for bank account validation

UK & Ireland Coverage

Validate all UK and Ireland bank accounts, building societies, and credit unions. Weekly data updates ensure accuracy.

Modulus Checking

Advanced modulus 10 and 11 algorithms verify account number validity against the latest BACS specifications.

Payment Type Detection

Know which payment methods each account supports: BACS, CHAPS, Faster Payments, Direct Debit, and more.

Global IBAN Validation

Validate IBAN for all participating countries worldwide. Support for 70+ countries.

Want to find out more?

Got a question for us? Contact us for a friendly chat about integrating into your platform or to find out about our services.